Macro Blog

A series of insights into macro economics and geopolitics by Steve Malin, our practice leader for the fund management business.

Latest posts

SaaS Companies Valuation: How to Value and Sell a SaaS Business?

26th September 2023

SaaS Business – the State of the SaaS Market

The global SaaS market has been bullish for some time now. Even though the CoViD-19 pandemic has resulted in a dip in the markets, it has been completely opposite in the case of SaaS. The pandemic has reinforced the importance of SaaS for businesses, the results of which can be seen in the past two years. From the year 2021 to 2022, the global SaaS has grown by around 19%. The latest value of the SaaS market, by the end of 2022, was $257 Billion and is expected to grow to $1298 Billion by the end of 2030. The average CAGR is 19.7% for the years 2022 – 2030.

In the United States, especially, the investment in SaaS startups climbed to $90 Billion in 2021. This is equal to the investments of the past three years combined, and a 150% growth in investments year-on-year. Various factors such as the huge migration to the cloud, enhanced cybersecurity investments, remote work, etc. drive the growth in investment for SaaS.

According to the report by BetterCloud, every organization will become powered by SaaS at some point, even though most companies are still in the early stages of adoption. This accompanied by the pressure to innovate, has also improved M&A activity in the last two years which was low in 2020 due to the Pandemic. Larger corporations are wanting to acquire early-stage SaaS startups that bring innovation to the table and have a competitive edge over their competitors.

At Sett & Lucas, we believe that the interest in SaaS businesses is going to consistently increase as new innovation, availability of funds, and interest in the latest technologies rise. We’re projecting a demand for high-quality SaaS businesses and we believe the demand will stay high through the decade.

When is the Right Time to Sell Your SaaS Company?

You have successfully built and grown a SaaS company. You have spent a lot of time and money to build a product that the market seems to like with moderate growth. So, what is the right next step? The right step is the one that feels right to you and it can be driven by anything from personal changes to business considerations. One such step/decision is to sell your SaaS business. The greatest dilemma that every SaaS founder faces is the dilemma of when and why to sell their SaaS business. Following are some factors to consider to decide if it is the right time to sell your company.

Growth Opportunities

This is one of the most important and common factors to consider when selling your SaaS business. Your business might be successful and early growth trends might have been sharp. But, there is a tipping point for growth and after some time it might slack.

Scaling your business to reach more markets or create more products require capital. The capital is for new hires, for marketing, and for improving the product. Most of the SaaS startups might just not have the revenue to do that. This might be due to your SaaS business model, which is usually low-cost, high-volume subscription/ sales. Some companies may thrive on fewer enterprise-level sales. Both models have their own defects, the biggest of which is revenue shortage to feed growth.

Large corporations have the funds and resources to scale your business. At this point, the most sensible option is to sell your SaaS business or to invite external funds for a share in the company. This can provide the means for your business to grow and reduces risk.

Market Consolidation

Say A and B are your competitors in the market. They offer similar products and have been consistently growing alongside. If one or both of your competitors attract a sale offer from large corporations and gets acquired, the chances are you might get an offer soon. Market consolidation is when companies from the same industry acquire each other to make bigger corporations to facilitate growth and innovation.

When you see trends of market consolidation, it might be the right time to prepare for a sale. There are two reasons to do that. Better funds from acquirers and investors mean growth. Another is that, if your competitors are already funded then it is high time you catch up or you might be left behind.

Changing Market Condition

Market conditions can change almost instantly. With that, the entire ecosystem of SaaS startups can change for good. Change in market conditions can happen due to anything ranging from a new regulation or a new innovation or worse a global pandemic. The rapid changes or rapid acceleration of the market, also known as the hot market, can create better funding/ sale opportunities for your business. And it is best if you utilize the same to scale and grow.

One such example is the CoViD-19 pandemic which accelerated the demand for cloud-based solutions for remote work and e-learning. Zoom skyrocketed its revenue by 300% during this pandemic and it is simply to change market conditions.

You’ve Reached Sale Value

Sale value is the average value that a business should reach in Annual Recurring Revenue (ARR) in order to attract investors and acquirers. For a software company, an ARR of $5 Million to $10 Million in revenue, brings many offers to the table.

Selling your business at the sale point gives you the opportunity to liquidate and scale your market and product. It also means that you have a product that has a good customer base and a target market. This gives you an advantage over your competitors and also gives a perspective for your business for the next few years.

Your Product is Not Whole Offering

Having a good product and customer base doesn’t necessarily translate to having a whole business model. Your SaaS product can be very niche and can solve a particular business problem in a particular industry. This might mean that your product is a good offering as a feature addition to an existing product set/ solutions rather than a product on its own.

In this case, the chances of your product being acquired by the existing product companies are more. Also, your product will be more valuable when provided as a whole business suite rather than a single offering. Hence, the best decision might be to sell your SaaS business in this case.

You’re Interested in Technical Aspect

As a SaaS founder, you might be into product development and the technical aspects of your business rather than the business aspect of your business. However, someone has to do the heavy lifting of running day-to-day operations and scaling the business.

If this is the case with you, you can hire more people. For a temporary cash flow, you can sell some percentage of your company or get a loan. However, this might not be sustainable for everyone. There is the option of selling the business to someone who can run the show while you focus on improving the product and making it world-class.

Factors Involved in SaaS Company Valuation

Business Age, Trends, & Market Trends

The business age, business trends, and market trends determine the value of SaaS companies and also the number of potential buyers interested in their business. A business that has relatively less history (less than 2 years) would have a small number of potential buyers. This is because the business performance in the future and its scalability cannot be determined with such short history. The higher the age of business, the more the business trends that can be seen. For example, a business with a trend for increasing revenue every year would appeal more to buyers/investors.

Similarly, market trends play an important role in the value of your business. If the SaaS industry as a whole is performing exceptionally well (which it is), the number of buyers and value of your business would be higher too.

Churn Rate

Churn rate is an important metric to consider while valuing your SaaS business. It represents the percentage of users who have unsubscribed or stopped using your services monthly or yearly. Acquiring customers is expensive and if your churn rate is high, then it means that you’re losing money if you’re just losing customers while spending to add new.

A lower churn usually means that your product is reliable and your customers are loyal to your brand. A churn rate of 5 to 7% is ideal and anything more than 10% is bad.

Below is the formula to calculate your churn rate,

Churn Rate = (Total No. of unsubscribed customers/ Customers at the start of the month) * 100.

For example, if you have 1000 customers at the start of the month and 50 have unsubscribed by the end of the month, then your churn rate is,

Churn rate = (50/1000) * 100 = 5%

Monthly Recurring Revenue(MRR) & Annual Recurring Revenue(ARR)

MRR and ARR determine the monthly and yearly revenue of a company for valuation. However, they cannot be both good metrics to measure a company’s performance. In short, MRR is the revenue that a company generates every month and it can be a good indicator of performance for SaaS companies that sell products/services on a monthly subscription basis. And ARR is the revenue of a company yearly and it can assess the performance of B2B SaaS companies that offer subscription services for a period of time such as quarterly, yearly, or multi-year contracts, etc.

Generally, buyers/investors are more interested in MRR than ARR since it replenishes company’s cash flow every month.

The formula for calculating Monthly Recurring Revenue is below,

MRR = (Price of Unit 1 x No. of Subscribers) + (Price of Unit 2 x No. of Subscribers) +…

Let’s say you have 5 customers who pay $10, and 10 customers who pay $15 every month. Then your Monthly Recurring Revenue is,

MRR = (5 x 10) + (10 x 15) = 50 + 150 = $200

The formula for calculating Annual Recurring Revenue for a bigger licensing period is below,

ARR = ((Price of Unit 1/ Contract Period) x No. of Subscribers) + ((Price of Unit 2/ Contract Period) x No. of Subscribers) +…

For example, if you have 10 subscribers with $10000 contracts for 5 years and 20 subscribers with $20000 contracts for 2 years, then the following is your ARR,

ARR = ((10000/5) x 10) + ((20000/2) x 20) = 20000 + 200000 = 220000

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the average cost that a company must spend on sales and marketing in order to acquire a customer in a given period of time. It is preferred to have a lower CAC, especially when your churn rate is higher. CAC correlates to Customer Life-time value to determine the profitability of a business.

CAC = (Total Sales and Marketing Cost/No. of Customers Acquired)

To give an example, if your total spend on sales and marketing is $50000 and you have acquired 250 customers at the end of the year, your CAC is,

CAC = $50000/250 = $200

Customer Lifetime Value (Customer LTV)

Customer Lifetime value is an important metric that provides the value of how much your customers would pay in their lifetime. The higher the customer LTV, the higher is your customer loyalty to your brand.

Customer LTV = Average monthly revenue per customer/Monthly Churn

CLTV: CAC Ratio

The ratio between Customer Lifetime Value and Customer Acquisition Cost, essentially provides the profit you make out of each customer. It is important that the LTV of a customer is always higher than the acquisition cost. In fact, the right ratio of CLTV:CAC is 3:1. Anything less than that is not desirable.

For example, if your CAC is $100 and your CLTV is $500, then your ratio would be 5:1 which is good.

Net Revenue Retention (NRR)

Net Revenue Retention is by definition the opposite metric to the churn rate. It is also known as the Net MRR Renewal rate, Net Negative Churn rate, or Net Dollar Retention Rate. It calculates the ratio of total expanded revenue over a period of time minus the churn with the MRR at the start of that period. The period can be typically a month or a year.

A Net Revenue Rate of more than 100% is always good and means that your business is expanding. This is a good indicator of growth and increases interest in potential buyers. The formula for calculating NRR is below.

NRR = (Monthly Recurring Revenue + Expansions + Upsells – Churn – Downgrades) / MRR at the start of the month

YoY Growth Rate

Year over Year Growth rate provides the percentage of growth in revenue in the current year when compared in the last year. This can be a great indicator of company growth, the increase in subscriptions, and capital efficiency.

YoY Growth Rate = ((Current Year Revenue – Past Year Revenue) / Past Year Revenue) x 100

TAM, SAM, & SOM

TAM is the Total Addressable Market which measures the size of the market a SaaS business can target. The market size can be anything from countrywide to worldwide. However, this is the total market, and expanding to the entire market can only be a long-term goal.

SAM is Serviceable Addressable Market. It determines the size or percentage of the total market that you can address due to various factors including location, marketing, etc. Essentially, it gives the size of the market you can try to compete in given your current business size and circumstances.

SOM is Serviceable Obtainable Market which is a metric that can be used to determine the size of the SAM that you can capture. This metric is used to determine the realistic goal that you can try to achieve within the determined market given your capabilities and competition.

Customer Acquisition Channels

The customer acquisition channels that your business uses to attract customers, be it digital marketing, SEO, ABM, etc. are important for the valuation of your business. The more channels you have, the more robust they are, and the more your business value.

A potential buyer would be interested in buying a business that has a clear acquisition strategy. They can expand into new strategies while refining and scaling the current ones.

Net Present Value (NPV)

Net Present Value provides the amount that a business is going to make throughout a given period of time. It is calculated to today’s money value and the investment is subtracted from it. A positive net present value indicates that the business is going to grow and generate revenue.

If your business is expected to generate $20 Million Dollars in the next ten years and if the investor is investing $2 Million dollars today. Then it means that the business is going to make $18 Million more than the investment which is a good indicator for business growth and value.

Three Ways of SaaS Valuations

There are various factors involved with SaaS valuation and it can vary for each business. However, the best way that most of the SaaS company valuation happens is through Revenue Multiples.

Revenue Multiples:

Using Revenue and revenue multiples for valuation is one of the most common and best ways to value a SaaS business. EBITDA and SDE value a business based on its profitability i.e. their earning potential. However, a SaaS business usually has to invest upfront in marketing, hiring, and other such practices to boost business growth. This would be added up to the expenses, resulting in less EBITDA. Also, as a result of all upfront investments, the business is expected to grow with more customers coming in and recurring revenue.

Revenue Multiple = Valuation / Revenue

The valuation and revenue data of publicly traded companies are readily available. These can be used to arrive at a common multiple. The multiple can then be used to determine the value of your business in the future.

However, using a common multiple for the entire SaaS industry cannot provide the right valuation. Hence, if you need to find the right multiple you can choose a similar type of SaaS business and calculate your multiple based on that. This would be more accurate than a common multiple since you’re getting more specific while calculating the multiple.

Finding the Revenue Multiple:

Finding the revenue multiple is one of the most crucial pieces of the puzzle. However, there are a lot of factors involved that can affect and determine the revenue multiple. Some of these factors are financial, operational, customer acquisition, etc. Following are some things that you have to consider while calculating the multiple,

1. Gross Margins – Gross Margin is the difference between net revenue and the overall costs divided by the net revenue. It is a metric that provides the percentage of revenue that is remaining after deducting the costs involved with running the business and offering the product/service.

Gross Margin = ((Net Revenue – Costs)/ Net Revenue) x 100

If the Gross Margin value is high, it means that the company has more room for scaling its business and high profitability. This in turn increases the revenue multiple and thereby the chances of investment. However, a low Gross Margin means that the business is struggling with operating costs and thereby the chances of an investment becomes less.

2. ARR Growth Rate – As stated before, ARR is Annual Recurring Revenue and the ARR growth rate is an important indicator of SaaS company growth and thereby an important factor in determining the revenue multiple.

ARR Growth Rate = ((ARR during the previous year – ARR during the current year)/ ARR during the previous year) x 100

ARR Growth rate indirectly represents the growth in revenue. This gives an understanding of a SaaS company’s capacity to retain existing customers and add new customers. This affects the multiple directly and thereby the chances of attracting an investment.

3. Rule of 40 – Rule of 40 is used as a metric to determine the company’s financial health and growth potential. However, it is important to know that the Rule of 40 is not a definitive rule or guarantees success.

Rule of 40 = Annual Revenue Growth Rate + EBITDA Margin

Annual Revenue Growth rate is the growth in revenue year-over-year. EBITDA Margin is the ratio of Earnings Before Interest, Taxes, Depreciation, and Amortization to total revenue.

If the sum of both is more than 40%, then it means that the company is doing a good job at managing its financials and has better profitability. If it is less than 40%, then it means that the company needs to better manage its finances and improve its profits.

4. Retention Metrics – Retention metrics are all the metrics involved with the customer loyalty, satisfaction, and the long-term revenue potential of a SaaS company. The following are the retention metrics involved with finding the revenue multiple,

- Customer Churn Rate

- Revenue Churn Rate

- Net Revenue Retention (NRR)

- Customer Lifetime Value (CLTV)

- Customer Acquisition Cost (CAC)

- Payback Period

5. Recurring Vs. Non-Recurring Revenue Mix – This represents the percentage of revenue that comes from recurring revenue (SaaS product) and from non-recurring revenue (Services such as implementation, integration, etc.). It is important for a SaaS company to higher percentage of revenue coming from recurring means. A company with more recurring revenue has higher growth and revenue potential in the long term.

6. Top Customer Concentration – It is important that SaaS companies have revenue coming from a diverse customer base. Top customer concentration is the factor that analyzes the customer base to see if the revenue is coming from a concentrated group of customers. This factor can affect the profitability and growth rate of the company in the long term. Companies with a concentrated customer base carry higher risk and are a concern to investors.

7. Dollar Value of Bookings and TCV – Dollar Value of Bookings gives the total contract value of new customers signed over a period of time. Total Contract Value (TCV) provides the full value of the contract including both existing and new customers over their full contract period.

Both these factors give the value of customer contracts and thereby the weightage of contracted customers to the total revenue. A higher value means more growth potential and is a positive sign for investors.

Simple Formulae for SaaS Company Valuation

Let’s get one thing on the table. There are no simple formulae for calculating the value of a SaaS company. Finding the value of a SaaS company depends on a lot of factors and it usually varies from business to business. However, the following formulae by David Cummings can help you better value your SaaS business or at the least give you an idea of what’s your worth.

David Cummings is an authority when it comes to SaaS valuation. He considers the following factors very crucial for the valuation of all types of SaaS business despite the myriad of factors involved. The factors are,

- Annual Recurring Revenue (ARR)

- Gross Margin

- Growth Rate

- Net Revenue Retention

The formula is as follows,

Company Value = 10 x ARR x Growth Rate x Net Revenue Retention

Based on the growth rate and net revenue retention, a SaaS company may be worth 15x based on a high rate and it can be 2x if there is high churn and less growth rate.

Conclusion:

It is important to have the SaaS valuation accurate for potential buyers, business owners, and managers. Without the accurate value, you will be blindfolded while making buying or selling decisions. No one likes a bad investment. So, if you are looking to buy or sell your SaaS business hire an expert M&A advisor who can help you with the same.

Sett & Lucas is an M&A advisory that specializes in the field of IT Services, Enterprise Software, Digital Marketing M&A, and Private Equity. If you are looking for trusted professionals to help with your selling and valuing your business, you are at the right place. Reach out to us today and let’s talk shop.

New corporate tax regime – Boom or bust?

12th January 2018

Corporate taxes are now lower but not simpler. Changes include reducing the corporate tax rate from 35 percent to 21 percent, mandating a one-time repatriation of offshore profits at a rate of 15 percent for cash and 8 percent for illiquid asset, and a new break for small businesses by creating a 20 percent tax deduction for sole proprietors and partnerships. In addition, businesses will be able to write off capital equipment immediately instead of depreciating it over a number of years.

The lowering of corporate rates is expected to stimulate US GDP which is already running at the 3 percent level. Expectations are that increased investment in the economy will drive corporate earnings during the next leg of the expansion. Analysts will be watching closely to see whether this investment materializes and whether employee salaries begin to rise after years of stagnating wages. This extra corporate cash could drive mergers and acquisitions in mid-market technology but high valuations may continue to put a damper on the largest transactions. Expect the added cash reserves to lead to executive pay increases, share buybacks and higher dividend yields. Enhanced cash reserves will also benefit corporate investment even if interest rates grind higher. Corporate borrowing will continue to fund growth but larger cash reserves should mitigate some borrowing needs.

The 21 percent corporate tax rate gives the US a comparative advantage and should, over the long term, drive increased international investment. Germany and Japan have corporate rates of 30 percent, while France is 34 percent. According to the OECD, among the larger economies only the UK has a lower rate of 19 percent. Skepticism concerning the new tax regime falls into three camps. The first group is concerned the tax decrease will blow the deficit out of the water. Expectations for 2018 and 2019 are deficits approaching 800 billion to 1 trillion per annum, extraordinary sums that will need to be paid as interest rates at the short end of the curve slowly move higher. The second group believes the tax benefits will end up in the hands of corporate executives taking massive salary and option packages. At a time of great income inequality there is fear of further alienating the large number of Americans just getting by. The third group of skeptics are concerned that lowering corporate tax rates could lead to tax competition and a global race to the bottom. How will Germany, Japan and other industrial countries react, will they lower tax rates in response, and could this lead to a decline in global tax receipts at a time of increasing government responsibility as our populations age.

The counter argument is that increased growth will be driven, in part by tax cuts, leading to an increase in national wealth. The argument is that innovation and productivity are driven by disruption and technological innovation. Lowering corporate taxes will provide the investment capital, according to this argument, to drive national prosperity. The ability to write off capital equipment immediately should lead to increased investment as well as corporations realize the tax advantages of locating factories in the US. In addition, the 20 percent tax break for individuals filing as a pass-through sole proprietorship or partnership will benefit this entrepreneurial class. A majority of new jobs in the US are created by small and medium size companies and, so the argument goes, increased cash flows will lead to new hires and new waves of innovation. Whether or not the new tax regime is a net benefit to the US economy will be an important factor in the November 2018 midterm elections. The Trump administration needs to show the American public that they are sound managers of the US economy. The midterms already look like tough sledding for the Republicans. They need to win the economic argument as they fight to maintain power in these divisive times. There is much to play for politically and we can be assured that the impact of tax reform will be center stage in the political battles to come.

Steven Malin

January 09, 2018

Focus on US and China investment policy

24th September 2017

Our expectations are that Chinese corporate investment in the US will continue to grow rapidly in 2017. The strengthening economy continues to make the US...

The Trump administration’s attitude toward Chinese investment in the US is being watched closely by the M&A community. The question asked is whether the concern emanating out of Washington DC about US and Chinese trade relations will spill over into US investment policy. Chinese corporate acquisitions in the US have tripled since 2015 with Chinese companies investing a record 45.6 billion in 2016. To place this in context, today Chinese firms employ more than 100,000 people in the US while Chinese private investment now exceeds 100 billion dollars.

Our expectations are that Chinese corporate investment in the US will continue to grow rapidly in 2017. The strengthening economy continues to make the US an ideal home for international investors. In addition, access to US technology assets is an essential component of global corporate strategy. There are, however, real headwinds which need to be watched. The Chinese government is concerned that capital outflows will weaken the remimbi which is already trading at historically low levels against the dollar. In the US, the Obama administration and the Congress have blocked the takeover of two separate technology firms by Chinese private equity investors while Chinese companies are waiting for regulatory approval for acquisitions worth 21 billion dollars. President- elect Trump, meanwhile, has made the return of American manufacturing jobs lost to China and Mexico central to his economic argument. On many occasions he has decried the dumping of cheap goods from China, arguing for ‘fair trade’ and positing a

potential tariff scheme.

The fear that trade issues, capital concerns, and national security issues will lead to a deceleration in cross border investments is in our view inaccurate. The national interest of both the US and China benefit substantially through bilateral investment. Leaders of both nations are acutely aware of the economic value of the China US relationship. Since 2000 US multinationals have invested over 200 billion dollars in China while the Chinese government has purchased over 3 trillion dollars of US treasuries. National security issues will remain complicated. The transfer of technology from the US to China is a constant concern of the US Department of Defense .Chinese naval policy has also raised concerns in the Pentagon. This is mitigated by US reliance on China as a partner to help backstop its strategy to contain North Korea.

Chinese strategic and private equity firms are accelerating M&A activity in the US in 2017. Digital marketing and IT projects and staffing firms fit a number of important criterions.

Digital firms provide technical talent and branding skills essential to success in the US market. IT project and staffing firms access a group of employees difficult to find and to retain in an extraordinarily competitive workspace. Expectations are that valuations will increase in 2017 as demand for these essential services remain at decade highs.

Steven Malin

September 24, 2017

Disruption in the energy and auto markets

24th September 2017

The cost of energy and the profits derived from its sale have endlessly fascinated economists, business analysts, journalists, investors and historians...

The cost of energy and the profits derived from its sale have endlessly fascinated economists, business analysts, journalists, investors and historians. American power, culture and foreign policy are entwined so closely with the rise of oil and gas as the world’s primary source of energy that it is almost impossible to envision what modernity would look like without this driver of industrial might, until now. It seems that we have reached the first stage in the disruption of an industry unrivaled in its impact on the fabric of modern life.

Disruption in the energy market is occurring due to dramatic changes in technology. The first change is within the oil and gas market itself with the rise of shale. The second is external, with the rise of Tesla and the electric automobile. The rise of Shale is well documented. Global oil production is 80 million barrels a year; the US produces 10 million barrels a year of which Shale accounts for 6 million barrels. The same holds in the natural gas market. The US will produce 74 billion cubic feet of natural gas in 2016 60 percent of which will come from shale. These statistics are remarkable. The acceleration of shale as a percentage of US production continues despite lower oil and natural gas prices. Private equity firms invested 57 billion dollars in shale producers in 2016. Oil giant BP is in talks to sell its North Sea assets where they have been production leaders since the 1960s in order to buy Shale assets. Tension among OPEC producers is high with Saudi Arabia and Russia (who is not a member) demanding compliance with

agreed to production cuts.

The rise of natural gas production from 8 billion cubic feet in 2008 to 44 billion cubic feet in 2016 also reflects on the decline of the coal industry. Coal and natural gas compete as fuel for the electrical grid. Utilities are moving at a rapid rate toward natural gas and away from coal and in 2016 natural gas surpassed coal in the mix of fuel used for US power generation. The electric automobile and the rise of Tesla is the second great technological disruption facing the energy industry. The rise of electric and potentially autonomous vehicles is disrupting the automotive and trucking industries as well as energy companies. 30 electric automobiles are now on offer. Less than 2 percent of cars are electric but growth is staggering. Growth in electric vehicles was 37 percent in 2016 and expected to be 70 percent in 2017. These numbers exclude the Tesla Model 3 which will move into mass production later this year and has a waiting list in excess of 400,000. Mercedes is this week allocated 1 billion USD to an Alabama plant to build their first electric SUV while BMW watches as the Model 3 take direct aim at the BMW 3 series.

In conclusion, the rise of the autonomous electric car will, over time, place a tremendous burden on oil manufacturers. The movement of legacy producers into shale is girded by shales dual role in both the oil and natural gas market. Coal, already in decline looks to decline further. The rise of solar power is an additional long term threat to both oil and coal. Environmental concerns over shale production are also a medium to long term consideration investors should be mindful of. Rapid technological change is upon us and the winners and losers are now being determined.

Steven Malin

September 24, 2017

Infrastructure and interest rates

22nd November 2016

Expectations are growing that the Trump administration will attempt to move a 1 trillion dollar infrastructure bill through the new Congress this January...

Expectations are growing that the Trump administration will attempt to move a 1 trillion dollar infrastructure bill through the new Congress this January. Legislation of this size would reshape public spending priorities for the next decade. It would fulfill an important campaign pledge and place the needs of the working class front and center as a policy priority for the first time in a generation. Trump is, of course, a builder and it is assumed he would be deeply involved in the rebuilding effort. Questions surrounding an effort of this magnitude abound. What rebuilding infrastructure are we talking about? Is it our collapsing inner cities, our decimated manufacturing towns, our crumbling airports, our waste water and drinking water systems, our railways, our energy and electrical works? Or are we also speaking about our information superhighway and our move to G5 and beyond. You see the problem and the opportunity, there is an awful lot that needs fixing, but how many of us believe our government, factionalized and dysfunctional, could take on such an extraordinary task.

The Trump administration could pass this legislation though the tactic known in political circles as triangulation.

By working with the Democratic minority in the Senate and House he could smash the deficit hawks and take the prize. Republican deficit hawks will be furious but he can offer them a consolation gift, a right wing Supreme Court Justice.

At least, this is what the bond market is prognosticating. Since the election the 10 year US bond has moved 60 basis points, from 1.71 percent to 2.31 percent.

The market is also predicting with 95 percent certainty, that the Fed will raise rates 25 basis

points in December. Will all this come to pass? We believe a large infrastructure bill will pass Congress. As always, the devil will be in the details. Will an infrastructure bill become a tax cutting exercise for the private sector or will Trump deliver real dollars for real projects? If 1 trillion dollars, or any amount close to that, moves through the Congress we expect GDP to smash though 2 percent and move north of 3 percent in 2018. Inflationary expectations are another matter and will be weighed against gains in productivity. One area of increased merger and acquisition activity will be technology infrastructure. Cloud computing and data integration are central to project coordination. Those firms at the nexus of technology and infrastructure are expected to see increased profitability, accelerated buy side interest and enhanced valuation in the coming year.

Steven Malin

November 22, 2016

Implications of the Dollar rally

22nd November 2016

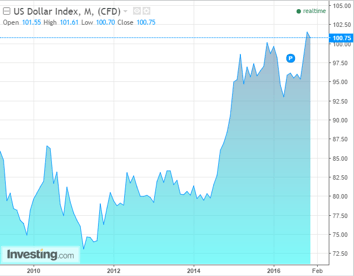

The US dollar has rallied to 13 year highs against a basket of major market currencies.

While the causes of the rally vary two underlying themes have emerged. First, one must consider that the dollar began its climb years ago as interest rate differentials between US treasuries and international bonds began to widen. This process is now accelerating post-election. 10 year US treasuries yield 2.31 percent up 60 basis points since the election. German 10 year Governments in contrast are yielding 0.20 percent while10 year Japanese Governments are yielding only 0.03 percent. Second, the US business cycle has diverged from its trading partners. Expectations of US GDP are 2 percent for 2017 but can accelerate north of 3 percent on the back of a predicted United States fiscal stimulus. Fiscal stimulus in Japan has so far failed to improve economic output, while in the European Union governments already burdened by high debt are attempting to stimulate their economies though expansionary monetary policy with limited success .

It is our opinion that the US dollar will continue to rise in 2017, reaching parity with the Euro while increasing in value against the Chinese Yuan, Japanese Yen and Canadian Dollar. The US dollar has risen dramatically against the British Pound and should maintain these gains.

The strong dollar will attract foreign investment to the United States as global companies seek to align themselves with American partners. The combination of a growing economy and strong currency will place American companies in an advantageous position 2017, enhancing valuation metrics and benefiting shareholders.

In addition, US companies considering acquisitions will take advantage of the strong dollar. An appetite for technology assets in Europe and the UK will lead US strategics and financials to accelerate global partnerships. We see increased interest from US and Chinese technology providers as they compete across a variety of platforms. In particular firms that provide digital marketing, social media and collaborative media (which joins television, you tube and social) are prime acquisition targets as firms integrate technology and culture in order to provide an enhanced experience for the consumer.

Steve Malin

November 22, 2016

Corporate tax rates and valuation metrics

22nd November 2016

Trump's domestic campaign policy includes lowering corporate tax rates while creating additional tax incentives for US firms to repatriate overseas income.

One of the central components of Trump domestic campaign policy is lowering corporate tax rates while creating additional tax incentives for US firms to repatriate overseas income. Republican control of both Houses of Congress makes tax reform likely and is one of the significant reasons US stocks have rallied post-election. The S&P 500 is at an all-time high led by Financial and Infrastructure companies who have been out of favour for years.

One of the ostensible reasons for lowering corporate taxes is stimulating corporate investment. In practice, however, corporates are already flush with free cash while borrowing costs are at record lows. So, what will companies do with the additional cash generated from lower taxes rates and repatriated overseas income? The answer, in our opinion, is twofold. First, companies will continue to buy back their own stock. Second, acquisition activity, now at record volumes will continue at an accelerating pace. Privately held tech companies will benefit as public companies stocks move higher. Competition among public companies for private assets will be fierce as they arbitrage public vs. private valuation.

Additional clarity on tax policy should be expected in the weeks leading up to the January State of the Union Address. In our opinion US equity markets will continue to move higher under these conditions. Regulatory reform is emphasized as a condition for economic growth. International corporations considering entering the US market have been concerned about high legal and consulting costs. Significant regulatory reform combined with lower corporate tax rates will accelerate an already vibrant middle market in mergers and acquisitions. Valuations will rise as lower taxes and less costly regulations benefit technology firms. Mergers and acquisition activity will increase as the financial arms of strategics and private equity firms reallocate resources due to enhanced metrics.

Steve Malin

November 22, 2016

Brexit and Foreign Investment

22nd November 2016

Prime Minister David Cameron's futile attempt to appease the Euro sceptic wing of the Conservative party has ended in calamity.

Prime Minister David Cameron’s futile attempt to appease the Euro sceptic wing of the Conservative party has ended in calamity. A year after winning a surprise second term as the UK’s Prime Minister he has been unceremoniously dumped. In the parlance of politics he resigned in order to spend time with his family. Which he will do, I understand, by going on a speaking tour at £150,000 per hour. You can’t make this stuff up. But there are lessons to be learned. Lessons involving arrogance, incompetence, carelessness, lack of preparation and on and on.

The UK, either the 5th or 6th largest economy in the world (they seem to swap places with France monthly) is , according to new Prime Minister Theresa May, going to exercise its option to leave the European Union, and formally announce that intention, by exercising something called clause 50, and will do so no later than March of 2017. The exercise of clause 50 will formally begin the process of leaving the Union. How long it will take to actually leave is anyone’s guess. The Europeans are saying there is a two year deadline, but that is extremely optimistic. UK law and EU law have become deeply entwined over forty years. The divorce will certainly take more than two. Someone once said, “Chaos is an opportunity”. Well, whoever said that, here is your chance. Fearing that the European Union has the upper hand in the negotiations to come, market traders have driven the Pound Sterling down over 30 percent.

Strategics and financials interested in acquiring UK assets in digital marketing, enterprise software and technology services now find themselves in the enviable position of buying on weakness at tremendous discounts. In our view, the opportunity to by strong companies at significant discounts is compelling. We cannot, however, recommend paying David Cameron £150,000 to deliver a speech, even if he recites Shakespeare.

Pound weakness is already peaking the interest of Chinese technology leaders Baidu, Alibaba and Tenement . These technology giants have led the way as Chinese firms spent a combined 64 billion dollars on mergers and acquisitions in the last 18 months. The top Chinese firms have brought their deal teams in house as they ramp up for 2017. UK companies specializing in enterprise software, cloud computing, data integration and digital marketing will benefit and be sort after as potential partners.

Steve Malin

November 22 2016